Fred Thiel Discusses the Evolving Interplay between Bitcoin and Gold Prices

Fred Thiel on Bitcoin vs. Gold: The Shift in Correlated Asset Dynamics | Cryptocurrency Insights

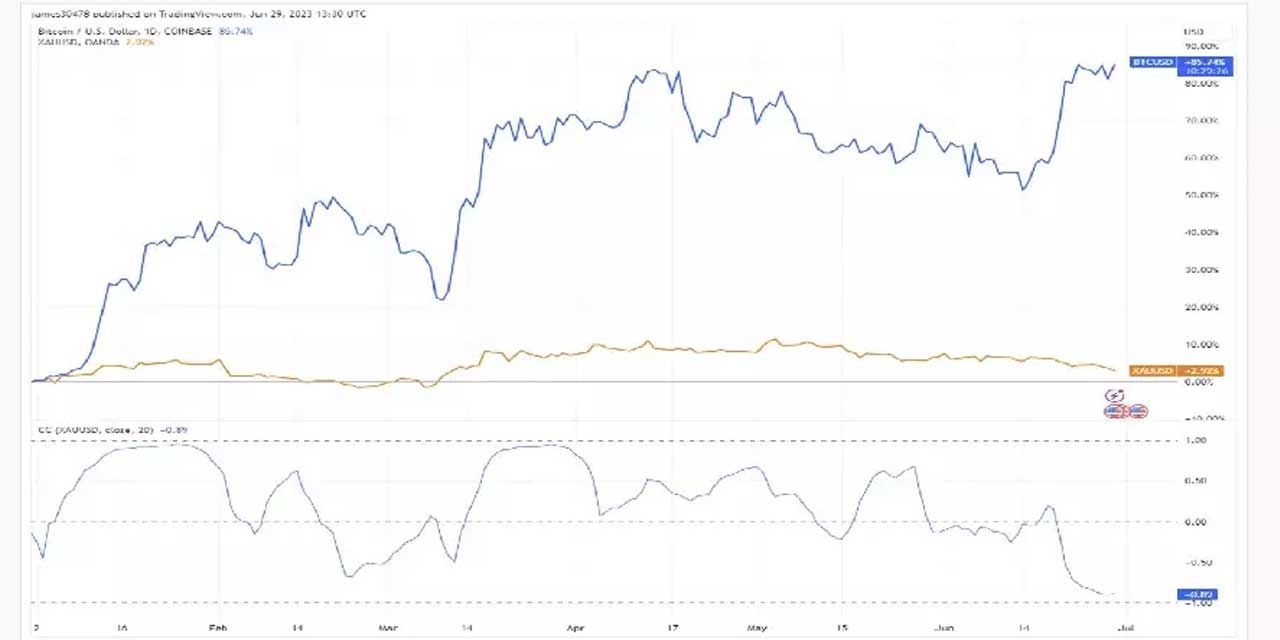

Marathon Digital's CEO, Fred Thiel, recently shed light on the curious financial dynamic that is surfacing between two renowned risk-mitigation tools, Bitcoin and Gold. The once-strong correlation between these two assets, traditionally used by investors as a hedge against market unpredictability, is dwindling, making the financial market a fascinating spectacle.

A Break in Correlation: Bitcoin's Upward Surge Vs. Gold's Gradual Descent

In an eye-opening contrast, Bitcoin's exchange rate displays an astonishing 85.7% surge, while gold's market value gently dwindles. This opposing behavior of assets, traditionally tethered together, has left the market intrigued. The correlation coefficient indicating the relationship between these assets has been inverted, standing at 0.89.

An Analytical Perspective: Kaiko's Insights on Bitcoin-Gold Correlation

Back in April, Kaiko, a prominent analytics firm, shed light on the Bitcoin-Gold correlation, pointing out that it was floating around 50%. Kaiko's analyst, Dessislava Aubert, then highlighted that this represented the most potent bond shared by these two assets in over a year.

Fred Thiel's Commentary on the BTC-Gold Dynamic

Thiel, discussing this unpredictable Bitcoin-Gold exchange rate dynamic, suggests a paradigm shift is taking place. He believes this reduction in correlation signifies more than just a change of preferences towards digital assets. It also portrays the broadening access to these assets for a more diverse investor base, offering them alternative ways to shield against market volatility.

MicroStrategy: The Bitcoin Bet

Adding another layer to this evolving narrative, MicroStrategy recently revealed their additional purchase of 12,333 BTC, costing them a whopping $347 million. MicroStrategy's adoption of Bitcoin as a preferred value store began in 2020. This acquisition, along with others, is a testament to the growing faith in cryptocurrency, especially Bitcoin, as a store of value.

Conclusion: The Ongoing Dance of Assets

Thiel's insights into the divergent behavior of Bitcoin and Gold, two traditionally interlinked assets, open up new discussions in the financial world. This unexpected dance between the digital and physical assets continues to impact the market dynamics and influence the strategies of investors worldwide. The evolution of these asset correlations will be a trend to watch closely in the coming years as the finance world continues to grapple with the digitization of value.